We reveal the big picture of your digital product and turn it into a real technical solution

The initial value I had from Mobindustry is blueprinting my idea into a product vision. During this process I realised the idea more clearly, it became real. Mobindustry team helped me to get the big picture.

Ramon Rhymes, Founder & CEO, Contracts Rx, USA

Get your dedicated product development team

Idea validation

We turn your business ideas into a technical blueprint and flesh it out in a prototype to make sure the product you imagine is technologically feasible.

We don’t just recommend features — We tie together:

- Market and competitor research

- Your needs, goals, and business operations

- User expectations

- Current trends in your industry

- Our 12+ years of experience

This allows us to create reliable solutions that work in the real world and bring tangible results.

Then it’s time to kick off development by following the product roadmap.

The idea validation process entails:

- Discovery phase

- Prototyping

- Product roadmap

- Technical feasibility

Full-cycle software engineering

Technical execution is as important as the product mindset. We ensure smooth and cost-effective development that results in durable, reliable, and scalable software leaning on:

- Experienced mobile and web app developers

- Scalable software architecture

- Continuous integration

- Agile methodology

Product management

Your business growth is our priority. Minimize risks with an MVP and grow as your product evolves. We’ll make sure your software never hits a ceiling and scales along with your business for years to come.

We provide you with:

- MVP development

- Product evolution

- Scaling

- Maintenance and support

Get an example of Discovery Phase documentation

Wondering where to start?

Validate your business ideas, minimize post-launch risks, and get a clear vision of your future product with a discovery phase. Learn what you will get as a result of the discovery phase.

We will send an example of discovery phase documentation to your email

Our product development workflow

Initial interview

Get to know each other, discuss your goals and needs, and plan out the next steps for your journey from idea to working product

Discovery phase

Create documentation that expresses how your business objectives are reflected in your product’s functionality

Design

Solve real problems your users face with each design decision

Development

Combine engineering best practices with our team’s own experience to deliver code that lasts

Quality assurance

Ensure your product works as intended and your users are satisfied with their experience

Deployment and launch

Make sure your product gets off to a smooth start, without hiccups or surprises

Support and evolution

Keep your product relevant and expand its reach by adapting it to new devices, changing industry standards, and your current business needs

Out-of-the-box software development for industries

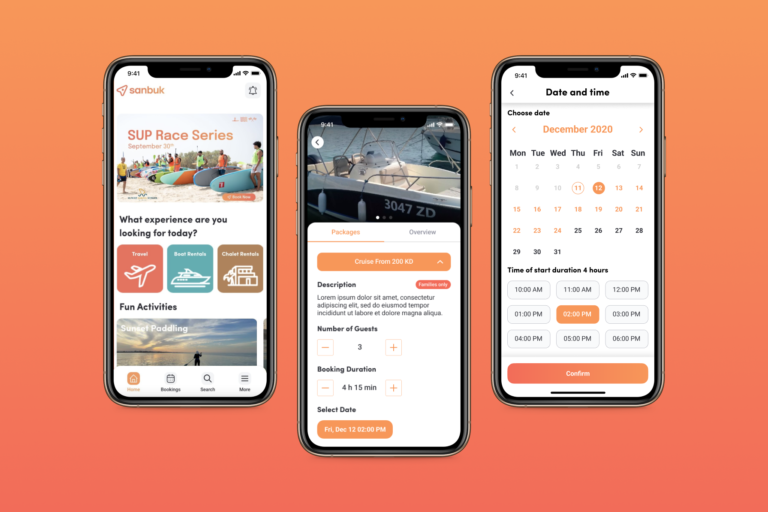

Our recent project

With Mobindustry, you get access to top-tier business and technical expertise we’ve accumulated over the course of 12 years. Our tight-knit Ukrainian team is able to support your project at every stage, from building the product concept from the ground up through release, maintenance, and marketing.