How to Build a Top-Notch Mobile Banking App: Features and Cost

Banks have been around since money appeared, and as money is changing, the banking system is changing too. According to Citi’s 2018 Mobile Banking Study, 81% of US consumers use their mobile devices to manage finances and 46% of US consumers have increased their usage of banking apps in the past year. Thought leaders believe that mobile apps will soon become a must-have for banks rather than just a trend.

Custom mobile apps for banks disrupting the banking system

Mobile banking development isn’t the same as it was just a few years ago. Statistics reflect people’s appreciation for the convenience of mobile banking: according to Citi, 91% of users prefer using apps rather than visiting a branch, and 68% of Millennials think their smartphone could replace their physical wallet.

Citi also found that 31% of people use their m-banking apps the most, surpassed only by social media apps (55%) and weather apps (33%). This is extremely good news for mobile banking, as most applications need to fight hard for user attention.

“Mobile banking use is skyrocketing as more consumers experience the benefits of greater convenience, speed, and financial insights driven by new app mobile banking application features and upgrades”

Banking apps don’t need to spend as much money on marketing as other mobile apps. Let’s talk about why they’re so popular.

According to Alice Milligan, the chief digital client experience officer at Citi, “mobile banking use is skyrocketing as more consumers experience the benefits of greater convenience, speed, and financial insights driven by new app features and upgrades.”

Banking experts believe that paperwork at banks is dying, and a modern bank can exist even without any physical branches. While this approach may seem extreme to some, Millennials trust banks that implement technologies and provide:

- instant payments anywhere;

- secure money transfers;

- convenient internet payments;

- valuable financial insights and personal spending statistics;

- instant blocking and replacing of stolen or lost cards.

These are basic functionalities and just a fraction of what a mobile banking app can offer to customers. Let’s explore what features can truly make a difference and transform a traditional bank into a leading digital bank.

How to develop a secure mobile banking app

Before we delve into specific features of mobile banking and mobile banking app development process, let’s discuss some general but extremely important traits a banking app can’t exist without.

Security

Security needs to be your first priority. While you need to make your app convenient for users, you need to keep their sensitive data and money secure.

While modern websites are rather secure, mobile applications offer a few extra layers of security. As app markets treat security seriously, they won’t even publish your app if it doesn’t comply with security rules. You need to develop a banking app with all security rules in mind.

Everything else depends on mobile banking app developers who make sure your app is secure and encrypt all data using special technologies like obfuscation. Here’s what you and your developers can do to make your app resistant to cybercrime:

- Choose reliable data storage

- Don’t store sensitive data, passwords, and transaction-related information on the device

- Implement two-factor authentication

- Put an inactivity timer on sessions

- Check user devices for security breaches before installing the app

- Educate users on security with a manual or guide

User experience

The user experience is vital for any mobile app, be it a social media, logistics, management, or healthcare app. Banking is no exception, and a pleasant user experience in banking apps is subtler than in any other mobile app, as it’s sometimes hard to maintain a healthy balance between respectability and entertainment in an interface.

An excessively formal interface that looks more like a spreadsheet than a mobile application won’t make people want to use your app. At the same time, it still needs to communicate reliability.

So how can you create a consistent and pleasant UX for your mobile banking app?

1. Make your app fast

No one likes slow apps, especially when it comes to making payments or trying to get information about accounts.

To optimize the loading speed of your application, make your app lightweight and choose only necessary features.

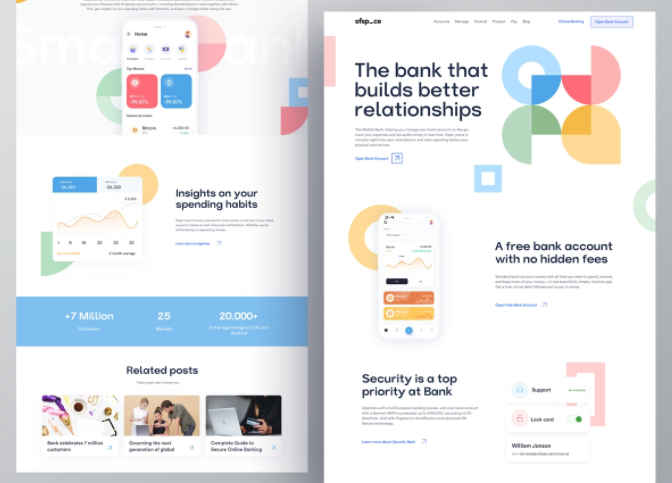

2. Sync your app with your website

Source: Banking Landing Page I Ofspace by Ofspace Digital Agency

Make sure your app is in sync with your website and that all information about recent transactions and changes in balances are reflected everywhere.

3. Guide users through your app

Almost everyone uses bank services, so your app’s audience will be very diverse. Don’t think that only tech-savvy Millennials will use your app (though they will probably make up the majority of your audience).

Guide users through your app so they feel comfortable with its features and layout.

While user experience and design is important for a banking app, features are the heart of your app. Let’s explore which features are absolute must-haves for any banking app and which ones you can add to stand out and give even more value to your customers.

3 best mobile banking apps 2022

Here are some banking apps you can get inspiration from. They allow basic banking operations and more, to ease the money management for customers.

1. Discover

Discover has consistently ranked high in customer service, and its app does not disappoint. In fact, Discover Mobile Banking App is the best full-featured banking app from The Ascent. This robust application is easy to use and works across several different devices. The application allows users to access account balances and transaction history, transfer money, pay bills and deposit checks. Users can view and send secure messages, and process all their credit cards from the online banking application.

2. Chase Mobile

Chase mobile is a banking application for money management. With it, users can pay their bills, check their deposit, transfer money to other accounts and keep track of their debts. Chase mobile allows to schedule payments: this helps to make recurrent transactions and prevent debt.

Chase mobile went further with its features and offers special deals that provide their users with rewards as they use the Chase Ultimate Rewards program. Chase mobile also offers additional security with its fingerprint scan functionality.

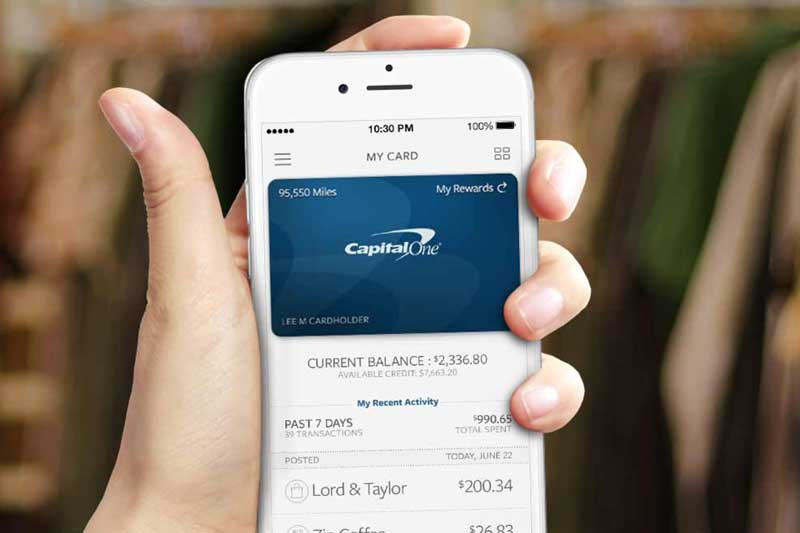

3. Capital One

Capital One banking app has great ratings in both Google Play and Apple App Store – 4.7/5 in both of them. It has lots of functions, allowing users to get loans, keep track of their credit score and more. Capital One is a more traditional banking app, but it uses the mobile functions to their fullest potential: for example, you can block your card right from a mobile app, if you lose it. There you can also report fraud. Capital One app also supports Apple Watch and allows fingerprint login.

Build a mobile banking app: Must-have features

You might be surprised, but there are only three core features customers need in a mobile banking app:

- Account management

- Quick transactions

- Access to customer service

Let’s look at these features in more detail.

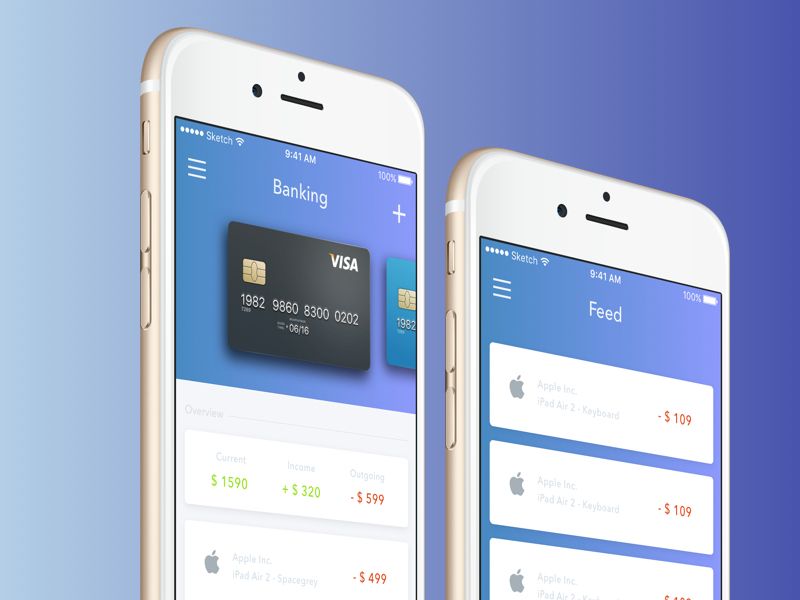

Account management

Account management is a big feature that consists of various small features related to account balances. Your app should let users:

- Check account balances — Remember that information should be consistent both in your app and on your website and should refresh instantly.

- Monitor and manage cards and bank accounts — Order a new card, close an account, etc.

- See all recent transactions — Transaction history is a must for account management in your mobile banking app.

- Check deposit — Showing deposit interest and its conditions is another thing that a mobile app should do, as well as opening a deposit account.

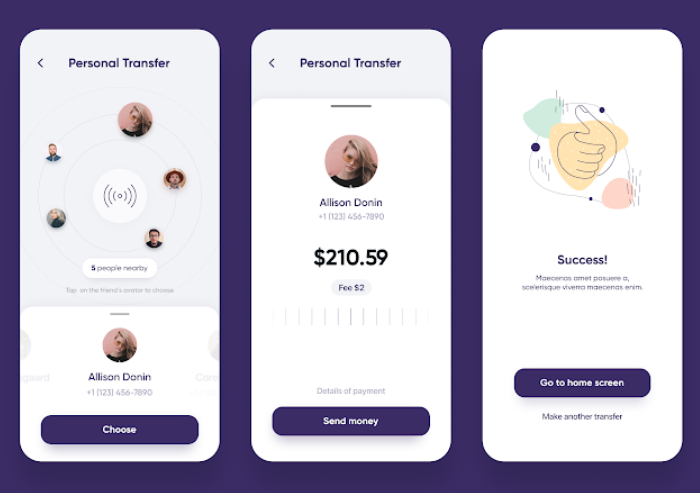

Quick transactions

Quick and seamless transactions probably are the most important feature of a mobile app. Let your customers transfer money between their own accounts or to other people’s accounts.

To enable mobile payments in a mobile app, developers will need to implement a system on your bank’s server. The app won’t actually process any payment information but will only reflect the transactions.

If your bank charges any transactions fees, don’t forget to warn users before each transaction and give the possibility to charge the fee either to the sender or the receiver.

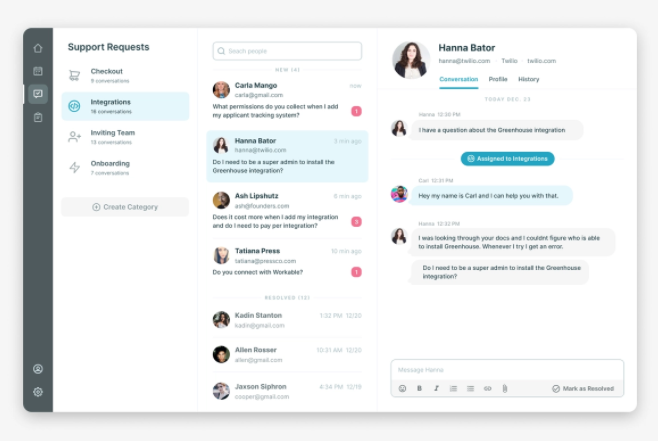

Access to customer service

Customer service in a mobile app can come in different forms: you can enable it by connecting your customers to your support team via a messenger or create a support chatbot that will respond to user requests 24/7.

Creating a chatbot requires a separate development process, as you need to know ahead of time what your customers might request. Investing in chatbot development can pay off massively, however, as you’ll be able to save money on your support team. Chatbots are able to answer user queries at any time of day or night.

Source: Chat Support by Zach Robinson

Although these are truly necessary features for developing a mobile banking app that will be valuable for users, they aren’t enough to provide a full-fledged mobile banking service. Next, I’ll tell you about other features your app will absolutely need.

Onboarding and personal accounts

A personal account is where all information about a user is stored. Moreover, it’s where a user can see and choose special offers (if you add them to your app) and make payments.

You can let users customize their accounts, but don’t overdo it.

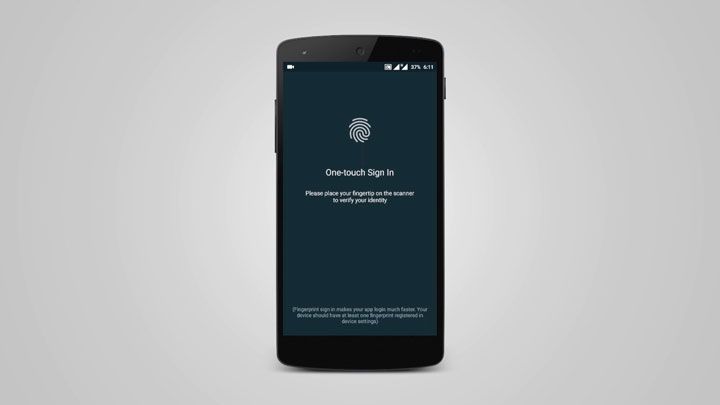

Secure authentication

Sign-in should be simple yet secure. Let users access their accounts in various ways.

Today, the best practice is to give users two options for signing in:

- Password

- Fingerprint

These are rather secure ways to protect the sign-in process and make sure no one will be able to access the account without authorization. Moreover, your app should request a fingerprint or an SMS code for each outgoing transaction.

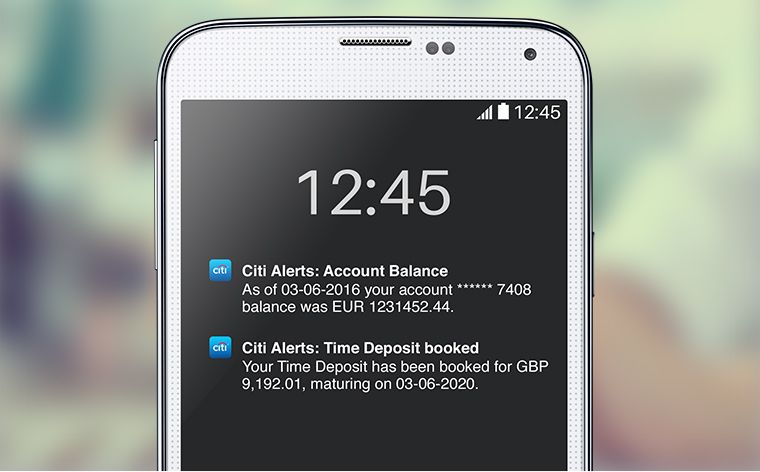

Push notifications

Push notifications are a must-have in any application, and banking apps aren’t an exception. There are three types of notifications you can send in a mobile banking app:

- Transactional — Notify users about everything related to their accounts

- Promotional — Inform users about deals, offers, and discounts

- Application-based — Request password changes or document submissions

Transactional notifications are the most important for a mobile banking app, so let’s discuss them in detail. You can use transactional push notifications to notify users about:

- Outgoing fund transfers

- Incoming money transfers

- Deposit interest payments

- Credential validation and verification

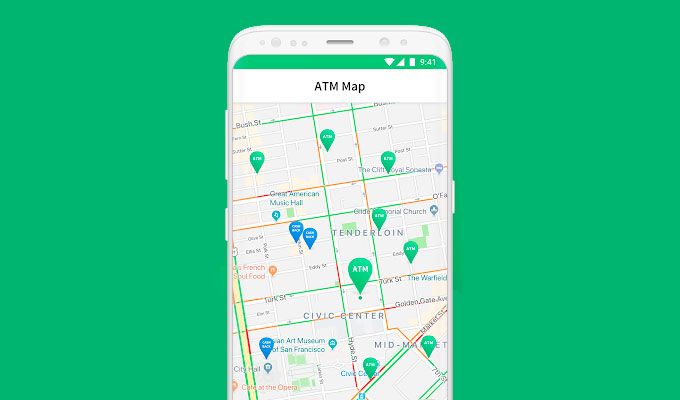

Locations of ATMs and branches

This is a rather simple feature that shows your care for customers. Showing the locations of ATMs and branches will require integrating maps into your mobile app. You can integrate Google Maps into both Android and iOS applications or integrate Apple Maps into your iOS mobile banking app.

To show ATMs or branches according to a user’s location, you’ll need to get permission from the user.

Showing working hours of branches can be a nice addition to this feature.

QR code payments

Enabling QR code payments will require access to a device’s camera. QR code payments are fast, and if there’s infrastructure that makes them possible (for example, QR codes in public transport or in shops), people can enjoy paying with their mobile devices instead of buying tickets for cash.

These are features you’ll definitely need in your banking mobile app. Now let’s talk about features you can add to your app to stand out among your competitors and give users a reason to use your app and your services without hesitation.

Features to add to custom mobile apps for banks

These are some additional ideas of features you can add to your app to make it more attractive for customers. While these features aren’t absolutely necessary, they can become a reason people install your app among many others and choose your bank as their favorite.

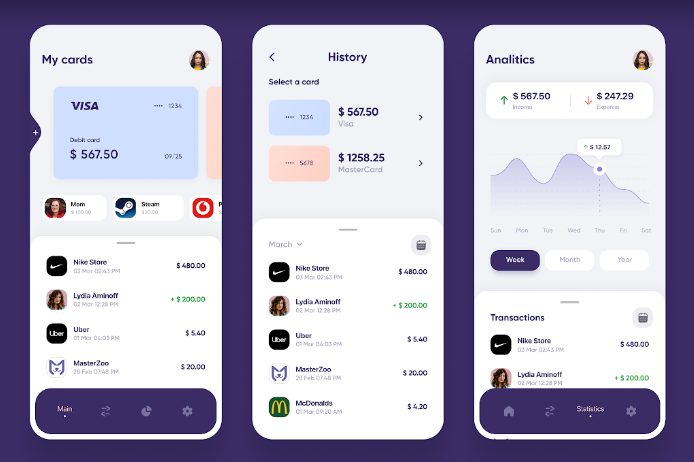

Spending tracker

Giving valuable insights on monthly spending can be one of the best features in your app, as people are concerned about how much they actually spend on different things.

A spending tracker typically consists of:

- Savings goals — Give users the ability to choose their own goals and set timelines for fulfilling them.

- Personalized reports — Avoid spreadsheets and try to present information visually using graphics and animations.

- Budget categories — Think about categories of things people spend money on, such as groceries, insurance, healthcare, and entertainment.

Repeat payments

Often, people make regular payments, and to help them not forget about these payments you can implement a regular payments feature. It can either automatically debit a certain amount from a bank account or notify a user that it’s time to make a payment.

Investing

If your internet banking system supports investments, add this functionality to your mobile app as well.

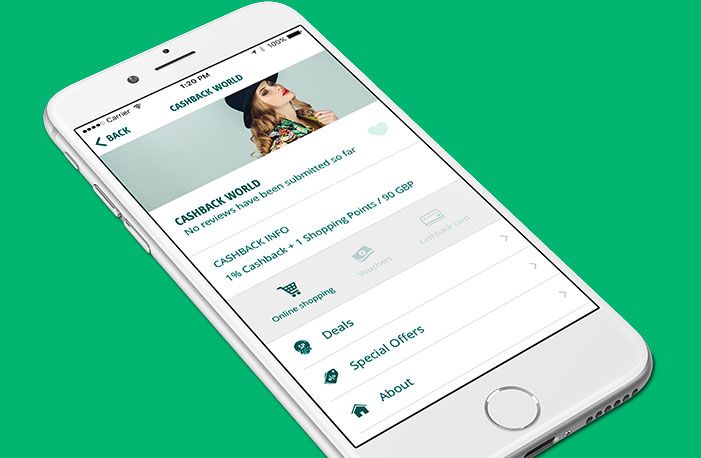

Cashback

Cashback is becoming more and more popular, and new cashback platforms appear all the time. Why not add this functionality to your mobile banking app?

Cashback is a very attractive feature that can make you different from other banks. Add a few categories and allow users to choose from what products or services they wish to get a few percent of cashback bonuses.

Special offers

If you want to promote your mobile banking app or increase user engagement, don’t hesitate to add some special offers that are unique to your mobile app. For example, if you’ve implemented a QR code payment feature, you might encourage people to use it by offering them discounts or cashback for each purchase they make via QR code.

Unique services

Modern banking isn’t just about managing bank accounts and making transactions. Banks offer way more than that, allowing users to buy plane and bus tickets, pay for utilities, order food, and deliver flowers.

You can partner with businesses and add their services to your mobile app. This will be more comfortable for users to order everything in one place and pay through a banking app directly rather than use third-party payment services. It will also be profitable for your business.

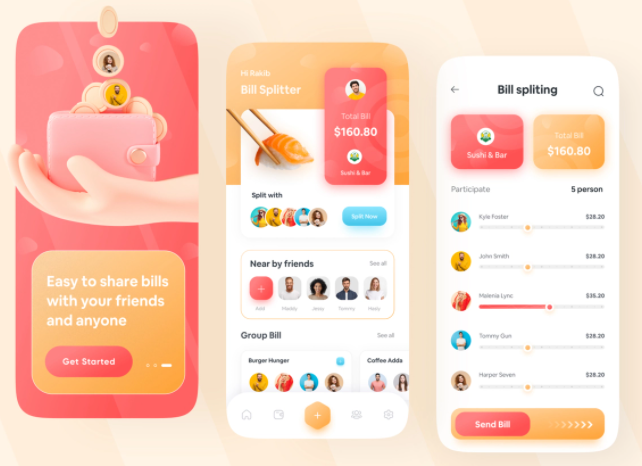

Splitting bills

Splitting bills is a great feature not only for financial startups, but also for established banking apps. Your customers will love it, as you’ll solve the everlasting problem of splitting a bill after eating out.

Google Pay and Apple Pay integration

Depending on what platform you want to support, integrating Google Pay or Apple Pay is a great idea. These payment services are becoming more and more popular, and you can allow users to make contactless payments using their accounts with your bank.

Mobile banking trends 2022

Biometric security

Biometric authentication was designed to improve the security of sensitive data and facilitate compliance with financial regulations. Using face, voice, fingerprint and other biometric recognition solutions helps prevent unauthorized access to accounts and devices. Additionally, financial institutions can protect themselves from identity theft, credit card hacking, skimming, and phishing.

AI-powered chatbots

An AI bot is a software solution that is programmed to perform specific tasks according to predefined scenarios. By using conversational technology, financial and banking institutions can speed up many manual and day-to-day tasks, thereby reducing response times from hours to seconds.

Machine Learning (ML)

The use of machine learning (AI categories) is one of the major trends in digital banking technology for 2021 and beyond. Using this advanced technology, financial institutions can analyze user data to determine the needs of customers. By solving their problems, banks are improving user experience and increasing revenue.

How much does it cost to develop a banking app

In this table, you’ll find the approximate time our developers would need to implement the features mentioned in this article. This will help you determine mobile banking app development cost if you know the hourly rates of developers in a mobile banking app development company you’ll hire.

| Feature | Estimate in days |

| Personal profiles | 2 |

| Onboarding | 2–4 |

| Authentication | 1–2 |

| Push notifications | 3–4 |

| ATM locations | 3–5 |

| QR code scanning | 1–2 |

| Payments | 3–8 |

| Savings goals | 2–3 |

| Spending reports | 2–4 |

| Budget categories | 2–3 |

| Repeat payments | 1–2 |

| Investments | 1–4 |

| Cashback | 2–3 |

| Special offers | 1–3 |

| Unique services | 2–5 |

| Splitting bills | 2–3 |

| Google/Apple Pay integration | 2–3 |

| Customer support | 2–5 |

| Chatbot | 4–7 |

Note that the final cost of developing a banking app will also include the preparation stage, time for quality assurance and communication, and fees for third-party services. The cost to develop mobile banking application depends heavily on the country your development team is located in. There is a drastic difference in hourly rates of developers in US and Eastern Europe, for example, but the quality is pretty much the same.

Conclusion

The time has passed when people chose a bank only for its reliability. Today, clients are more demanding, and they favor banks that make their lives easier. Mobile apps were created just for that purpose. With a mobile app, your bank can make payments easier and faster than ever. The blockchain and big data are two technologies that will disrupt next-generation banking systems, but for now mobile banking remains the priority.

In this artilce we discussed how to develop a fintech app, the main mobile banking application features and challenges you need to look out for when you create your own online bank.

If you’re currently shortlisting fintech app development companies to increase your online presence, we’ll be glad if you add Mobindustry to your list. To find out more about our company and how we work with clients, visit this article. Our mobile banking app developers have created the first versions of the biggest mobile banking app in Ukraine.

Frequently Asked Questions

- Biometric security

- Artificial intelligence-powered chatbots

- Machine learning