How to Create an App Like Credit Karma: Business Model and Technologies

Credit score is one of the most important aspects of modern life, as it allows financial institutions to check customer’s reliability and offer them various financial products and opportunities. Apps like Credit Karma help people to track their credit scores and better manage their finances. Learn how to build a credit score app of your own and make money.

Credit score determines people’s financial possibilities to take a loan, get a mortgage, buy a car or get a new card with special offers. Applications like Credit Karma help people to estimate their creditworthiness and get offers from banks and other financial institutions.

Credit score determines people’s financial possibilities to take a loan, get a mortgage, buy a car or get a new card with special offers

In this article you’ll learn about the business model of applications like Credit Karma, their main features and services. I’ll also tell you about how to build an app like Credit Karma, what functionality you’ll need to add, and what technologies are the best for such an application. I’ll also talk about how Credit Karma makes money and do a thorough Credit Karma app review.

Before we dive into the development part, let’s talk about the Credit Karma app and what makes it so successful.

What is Credit Karma?

Credit Karma is an American financial company that was founded in 2007 and provides individuals with a free financial management platform. Along with that, Credit Karma also offers property monitoring, dispute tools and other services like tax filing.

It also provides guides for users on how to improve their financial health and suggest the most beneficial cards based on the likelihood of their approval. Credit Karma’s services also include recommendations on personal, home and auto loans that are also recommended based on a score.

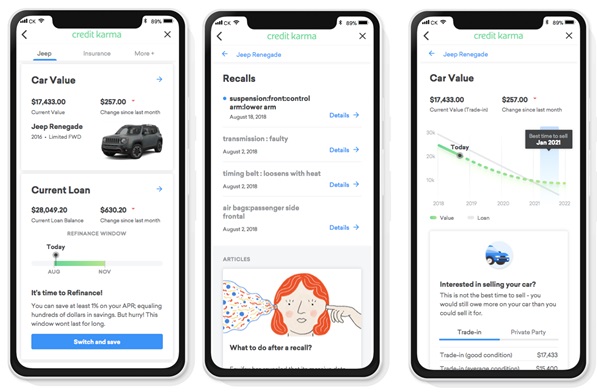

Credit Karma has a web platform as well as a mobile application for both Android and iOS, that has unique features. The Credit Karma competitors include Mint, Credit Sesame and NerdWallet. These platforms also provide free credit score data and financial services to their users.

Credit Karma operates in the US, Canada and the UK, and has over 110 million active users in these countries as of February 2021. In 2013 they only had 8 million users, so their user base is growing rapidly. In December 2020, Intuit acquired Credit Karma for approximately $3.4 billion in cash and $4.7 billion in stock and equity awards.

All the services in Credit Karma are free for the users, so how does it make money? Let’s talk about the Credit Karma business model.

How does Credit Karma make money?

As I already mentioned, the services of Credit Karma are completely free to users. What is their business model then? The main source of the Credit Karma revenue is targeted advertisements.

Unlike other services of such kind, this business doesn’t sell personal data of their users to third parties. Instead, they partner with lenders who pay the company to get recommended to the most relevant users. Credit Karma gets paid each time their user buys a recommended service from their partner.

The users of the Credit Karma application can get access to their financial information for free at any time without having to register a credit card

This means that this app works according to the aggregator business model, and gets money through different kinds of fees that include referral fees, interchange fees and interest on cash. Let’s talk about these fees in more detail.

Referral fees

Referral fees are the main source of revenue for Credit Karma. They receive money each time a user signs up to a recommended service. The services are put in different categories like:

- Cards (business, travel, cash back, etc.)

- Loans (personal, home, auto)

- Automobile insurances

- Mortgage

Credit Karma analyzes the user data to offer the most relevant services based on their financial situation, spending habits, financial history and score.

Another application that uses a similar monetization strategy is ClearScore — a UK-based fintech company.

Interchange Fees

Credit Karma offers users its own bank account called Credit Karma Money that comes with a Visa debit card. The app makes money from an interchange fee that’s applied each time a user makes a payment. The commission is less than 1% of the purchase price, and it’s paid by the seller who receives a payment. Credit Karma gets a share of this fee as well.

Interest on cash

Credit Karma uses cash on its users’ accounts to lend it to other institutions like banks. Then, it earns money from banks that pay interest on cash they got.

The users of the Credit Karma application can get access to their financial information for free at any time without having to register a credit card. This means that users can be sure that they won’t be charged any unexpected fees.

In order to build a successful application like Credit Karma, you’ll need to attract financial partners and set up an algorithm that will suggest the most relevant offers to your users based on their financial information and history

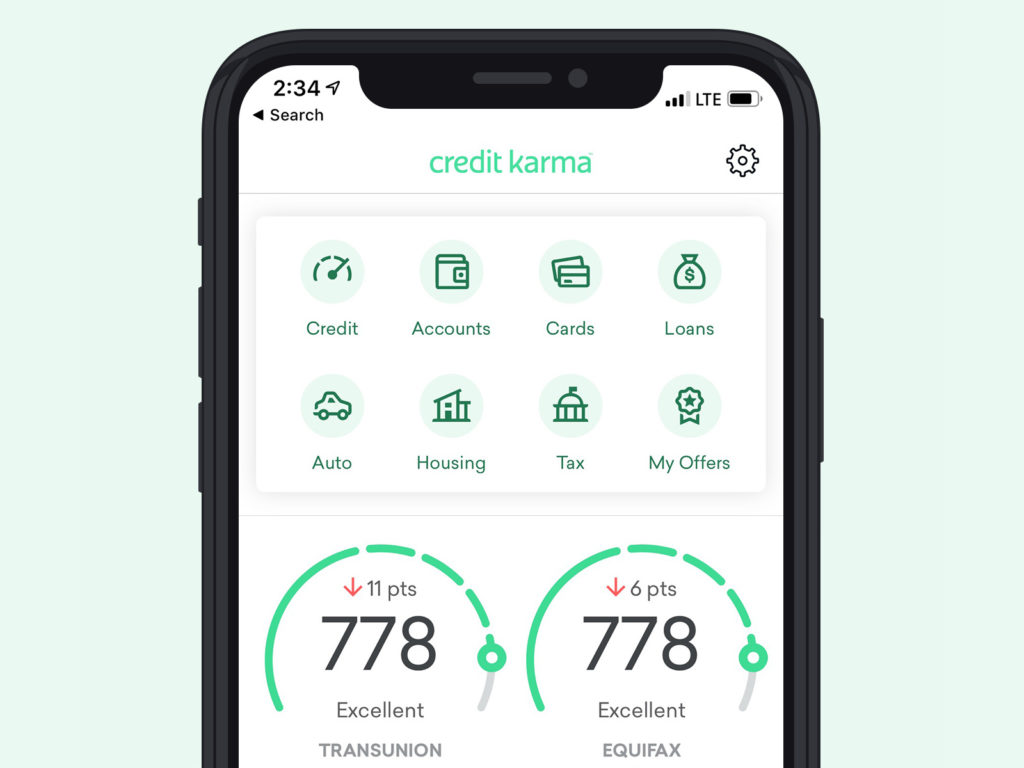

Compare it with the largest credit bureaus that give free access to financial information only once a year, and charge customers for any additional requests. Providing free information at any time is what makes Credit Karma one of the most popular and successful credit score apps in North America. Where does it get the credit score information? Credit Karma sources data from two largest consumer credit bureaus — Equifax and TransUnion.

So, in order to build a successful application like Credit Karma, you’ll need to attract financial partners and set up an algorithm that will suggest the most relevant offers to your users based on their financial information and history, and of course develop a mobile application along with a web app.

In this article I’ll focus on fintech mobile app development. Let’s look at the features that your service will need referencing Credit Karma that has already built a successful fintech application for credit scoring.

Credit Karma’s competitors

If you plan to develop an app like Credit Karma, make sure you also check other companies like Credit Karma in the market of the scoring apps. Here are the top competitor companies of Credit Karma.

NerdWallet

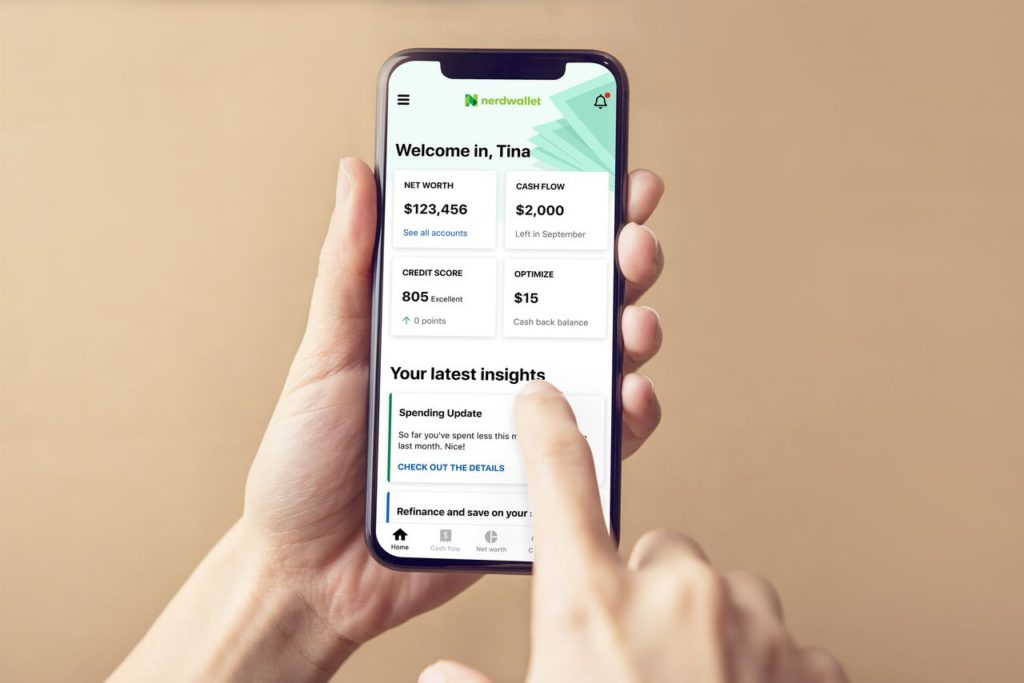

NerdWallet is a fintech company that allows its customers to check their financial information like credit score and also receive insights about their financial health. Just like Credit Karma, NerdWallet offers users various financial products and provides advice on finance management.

Bankrate

Bankrate gives its users access to a wide range of financial services and products, as well as in-depth financial reports.

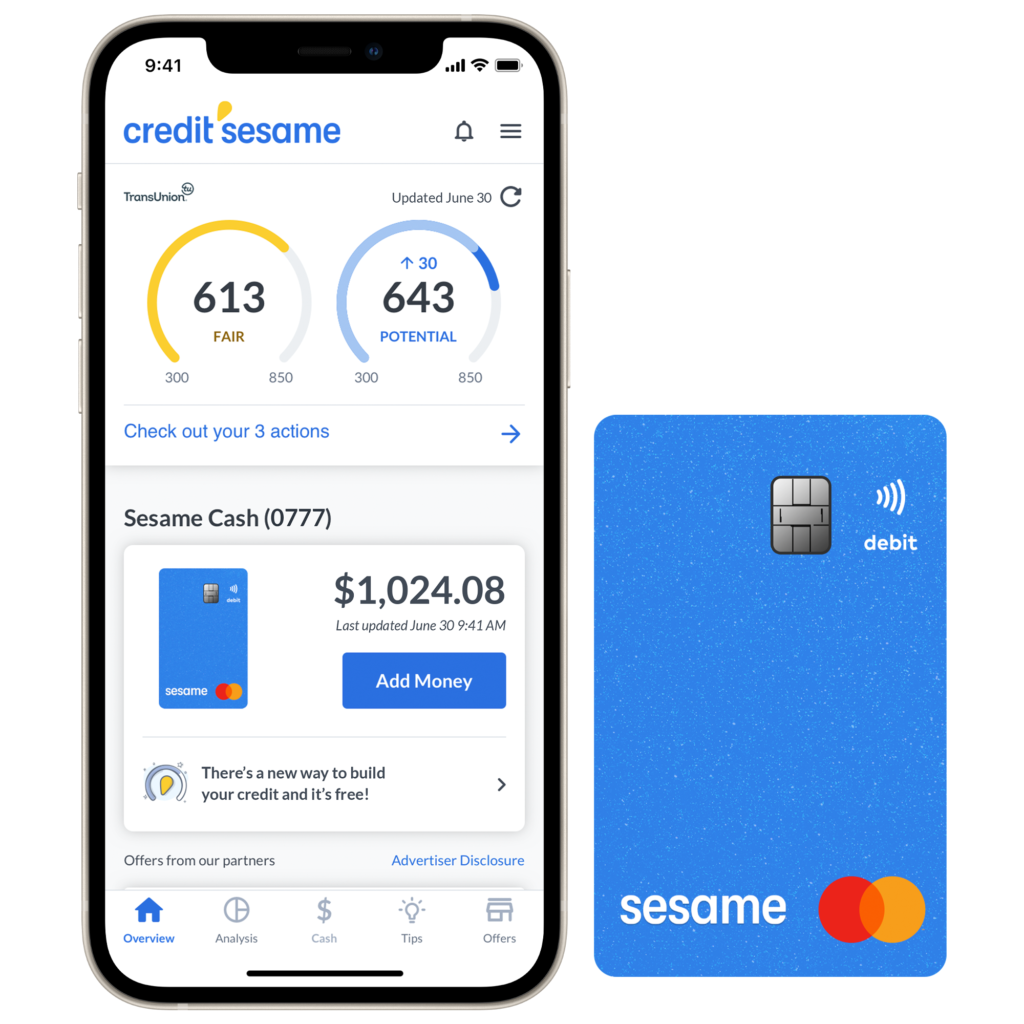

Credit Sesame

Credit Sesame offers various financial tools for its users, as well as advice on how to effectively save money on loans. Credit Sesame is most famous for its identity protection services.

Must-have features of a credit score application

Let’s look at the Credit Karma features that you can include in your own credit scoring app as well.

Sign up and login

Provide your users with several ways to sign up for your service and log into their accounts. Depending on the device, Credit Karma allows users to log in via:

- PIN

- TouchID

- FaceID

You can also authenticate users through their phone number and email address. Make sure to add two-factor authentication into your application for security.

Onboarding

Fintech applications like Credit Karma usually are rather feature-rich, so I advise you to add an onboarding tutorial for your new users. This will allow them to get familiar with your application and easily navigate through features and tools in it.

Personal profile

A personal profile should contain all the information about the user, including their linked bank accounts, personal data like name, date of birth and other details necessary to form their financial profile.

Push notifications

Push notifications allow you to communicate with your users. Tell them about your new features, special offers, changes in their credit score and other valuable information. Don’t overdo the notifications, but also send them regularly to remind users about your application.

App settings

Allow your users to set up their own environment in your application, for example, adjust the push notifications, change personal preferences and details.

Credit score ratings

Present the information about your users’ score through clear and informative graphs and charts. Create a dashboard that will visually represent the data you retrieve from score bureaus.

Credit score simulator

Credit Karma shows users how their score may be affected by certain actions. Provide your users with tips on how to improve their score and prevent them from making mistakes.

Personalized offers

List all the offers from your partners on one screen and make sure the offers are relevant to your user’s score. Show the likelihood of approval based on your user’s financial situation and list the benefits that come with each loan, bank card or other offers.

Search and filters

Allow your users to search for the best offers in specific banks using advanced search and filters. Categorize your offers according to their types, for example, cards in Credit Karma are categorized into:

- Shop cards

- Balance credit cards

- Rewards cards

- Travel cards

- Cash back cards

- Business cards

- Cards for bad credit

- Cards for good credit

- Secured cards

- 0% ARP cards

Loans

Allow your users to review the available loans and take them right from your app. Like any other offers, loans should be presented according to their availability to a user based on their income and financial history.

Payment gateway

If you plan to integrate your own payment system into the application, you’ll need to add a payment gateway so your users can transfer money through your application. PayPal, Stripe, Braintree are some of the most popular payment options for mobile applications.

Financial advice

Show care about your users and provide them with personalized advice on personal finance management. Gather all resources in one section of your application and suggest information about savings, loan recalculation, financial support programs from the government and more.

Credit reports

Allow your users to download their report from your application to their mobile devices. A report should list the financial history and score.

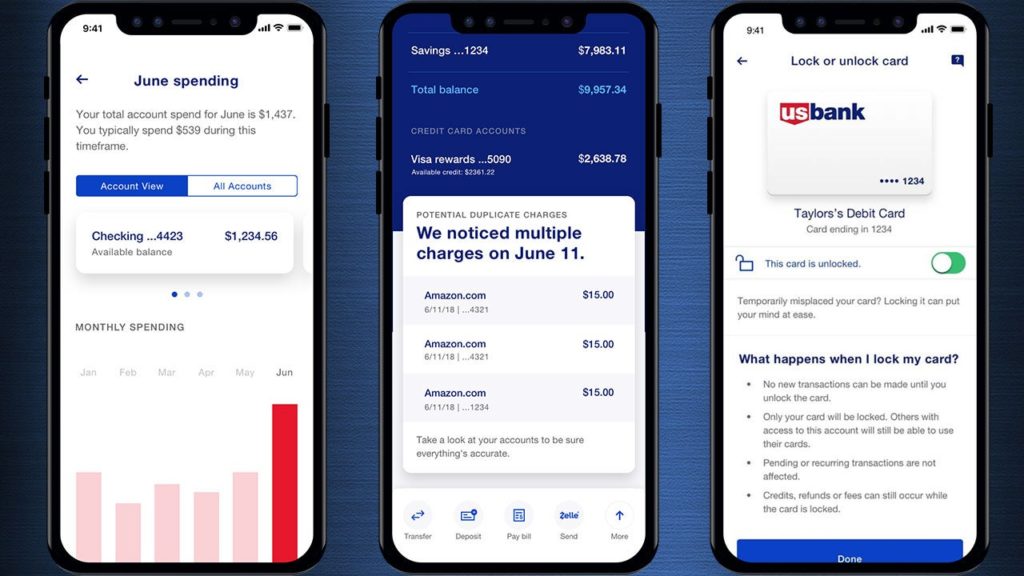

Linked bank accounts

Your users should be able to add their bank accounts to your application so you can analyze their financial situation, spendings and more.

These are the main features for a scoring application. You can include them into your MVP and then work on new features that will provide an even better service to your customers.

Note that Credit Karma is a large service that has been in development since 2008, so there are already a lot of services available in it, from mortgage loans to car insurance. Your goal will be to prioritize features based on your target market and audience, and develop an MVP first.

What technologies to choose for an app like Credit Karma

Though such applications are rather feature rich, they don’t require any complex functionality, so there’s a wide variety of technologies that can be used for such an application. Let’s look at the most popular options for such an application in terms of its tech stack.

Mobile application

Before choosing the technologies for your application, you need to figure out what platforms you’d like to cover. Most modern businesses build applications for both Android and iOS to provide their services to a maximum number of users.

If you decide to build an app for both platforms, you need to choose between native and cross-platform development.

For building native apps for Android and iOS I recommend Kotlin and Swift respectively. If you don’t want to build two separate apps for both platforms, you can build a single cross-platform application using Flutter.

Along with choosing a programming language and a framework, you’ll also need to pick libraries and third-party APIs for payment gateways, social logins and user interface elements.

Server side

The server side is the backbone of your application, as it’s responsible for the business logic of your app and storing and managing data.

Programming languages

The most popular programming languages used for server-side development include:

- PHP

- Ruby

- Java

- Python.

Databases

Databases are a vital part of the server ecosystem that allow multiple data points to be maintained and processed. The most popular databases are:

- MySQL

- MongoDB

- DynamoDB by Amazon

- Firebase by Google

- PostgreSQL

Storage

The most popular storage solutions are:

- Amazon Simple Storage Solution (AWS S3)

- Firebase Storage by Google

Now that you know what features and technologies are recommended for a fintech app, let’s talk about the development process of such an application.

How can Mobindustry help build an app like Credit Karma

At Mobindustry we have created different fintech products, from banking apps to digital wallets. How does the process of building a fintech application go at Mobindustry? Let’s look at the main steps.

Step 1. Idea and vision

Before you contact your vendor, you need to define your idea for an application. In your case, “I want to build an app like Credit Karma” is an idea. A vision should also include the peculiarities of your own target market and something that will make you different from other similar apps.

When you find your vendor, contact them and talk about your idea. Your vendor should provide you with a rough estimate based on your vision, and after you agree on moving forward, it’s time for a discovery phase.

Step 2. Discovery phase

Now it’s time to turn your idea for a fintech app into a concrete plan. During the discovery phase, a business analyst will communicate with you to extract the requirements for the future product and conduct researches like target market and audience analysis and competitor research.

As a result of a discovery phase, you’ll get a technical specification — a document that describes everything about the application, from technologies and functionality to third-party services and people responsible for the delivery. Along with this documentation, you can also get wireframes and interface design.

At this point you’ll also get a detailed estimate of the whole project and prioritize the features for the MVP.

Step 3. Preparation, development and testing

Now that the plan is ready, it’s time for development. After our software engineers prepare the development environment, they start the development process. The quality assurance happens almost simultaneously with the development — each time a part of code is produced, it’s immediately checked. This allows developers to ensure the quality of code and also save time and your money on final checks.

Step 4. Final testing and release

After the application is ready, it’s time to make a full regression test and prepare it for the release. Both Google Play and App Store have strict rules and requirements for applications, so your developers will make sure your app is compliant with the rules.

After the release you’ll need to regularly check the analytics and watch how your audience is accepting your application, what the most popular features are, and where the bottlenecks appear.

Step 5. Maintenance and support

The work on your app doesn’t stop at the release, so be prepared for regular maintenance that includes testing, security checks, third-party libraries updates, updates for the new versions of the operating systems, and so on.

You should also continue working on new and existing features, adding and improving them based on the market trends and your users’ expectations and behavior.

Final thoughts

Now you know how Credit Karma works and how to build an application like Credit Karma. At Mobindustry we can recommend you the best tech stack and functionality for such an application, and provide services on each stage of the development cycle.

Contact us to find out about the cost of building an application, or receive a consultation on its monetization, technologies or features. We’ll be happy to help you build a successful fintech application.