How to Choose a Payment Gateway for Your Ecommerce Project

In this article, we talk about different payment gateway options and how to choose one for your e-commerce project.

What Is an Ecommerce Payment Gateway?

A payment gateway is a software application that securely transfers credit card information from a website to a credit card payment network that processes ecommerce payments. It then transmits transaction details and responses from the payment network back to the website.

While online transactions may seem quick and easy from the perspective of customers, on the server side, multiple processes work together to seamlessly and securely transfer funds from buyer to seller.

Payment gateways can perform the following types of transactions:

Authorization transactions confirm that the customer has sufficient funds to pay. They do not include the actual charge. Instead, during authorization, the merchant confirms that the cardholder can pay for the order. An authorization transaction is used for orders that take time to ship or manufacture.

Capture transactions process previously authorized payments and result in funds being credited to a merchant’s account.

Sale transactions combine authorization and capture transactions. The cardholder is first authorized. Then funds are transferred if authorization is successful. A sale transaction is a regular payment for immediate purchases of items such as subscriptions or e-tickets.

Refund transactions are the result of a canceled order for which the seller needs to return money.

Void transactions are similar to refund transactions but can be made if funds have not yet been transferred.

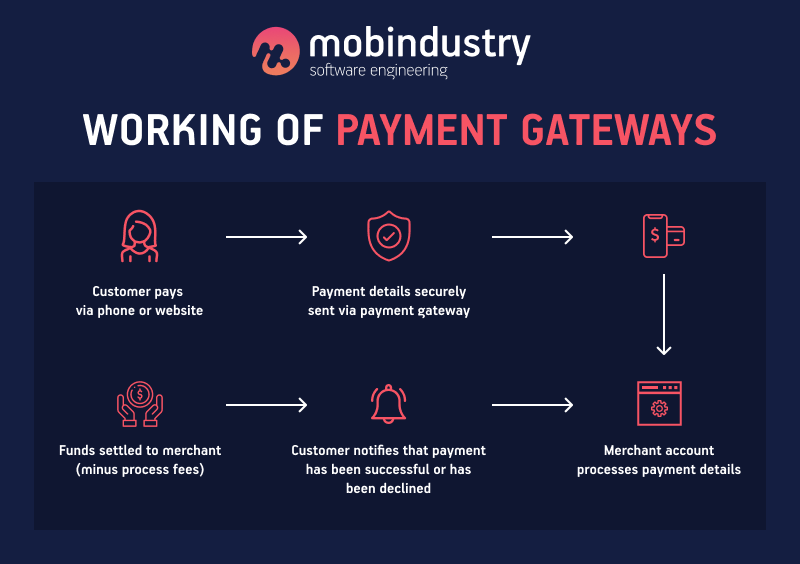

How does a payment gateway work?

Payment gateways make payment processing efficient, secure, and hassle-free. While they don’t transfer funds themselves, payment gateways approve the transfer of funds from customers to merchants in a way that is safe and reliable.

Payment gateways comply with Payment Card Industry (PCI) standards, implementing various security methods to prevent fraud. Here’s how an ecommerce payment gateway works:

- The payment process begins as soon as the customer places an order on the ecommerce website and enters all required credit card details.

- The web browser encrypts the data sent between it and the merchant’s web server.

- The payment gateway sends transaction data to the payment system used by the merchant’s acquiring bank.

- The payment processor sends transaction data to the bank’s card department.

- The card-issuing bank sees the approval request and approves or rejects it.

- The processor then sends a seller and buyer confirmation to the gateway.

- As soon as the gateway receives this response, it sends it to the site/interface to process the payment.

- Clearing transactions are activated after the merchant completes the transaction.

- The issuing bank places an authorization hold on the card, allowing for settlement with the issuing bank.

Choosing a payment gateway provider

Here are a few things to consider before choosing a payment gateway for e-commerce app development.

Pricing

Payment processing is complex, as it involves multiple financial institutions and organizations. Like other services, a payment gateway charges a fee to use third-party tools to process and authorize transactions. Each party involved in verification/authorization or payment processing charges a fee. Transactions are usually billed based on the amount, location (in-country or abroad), and product type (physical or digital).

Each payment solution provider has its own terms of use and fees. Typically, you’ll have a gateway setup fee, a monthly gateway usage fee, a trading account setup fee, and a commission for each processed transaction. Read all pricing agreements to avoid hidden fees and additional costs.

Merchant account options

A merchant account is an agreement between a merchant and an acquiring bank whereby the merchant allows the bank to process its transactions. In addition, the merchant agrees to abide by the operating rules for processing credit cards set by credit card companies.

A merchant account can be opened through banks or payment gateway providers that offer merchant accounts as part of their services. These include payment systems. If you already have a merchant account, consider what your provider has to offer. If you don’t, it’s best to choose a provider that offers a merchant account from the outset.

Support for payment methods and currencies

Credit cards (preferred by 42% of online shoppers), e-wallets such as PayPal (preferred by 39%), and debit cards (preferred by 28%) were the most popular payment methods as of March 2017, according to Statista. But this doesn’t mean you should only support these methods. Mobile payments are generating more revenue for businesses every year, reaching $930 billion worldwide in 2018. In ecommerce, mobile payments mean using e-wallets. These are apps like Apple Pay, PayPal, and Google Pay that store your credit card information or directly store your money, allowing you to shop online without a bank account.

Make sure your payment gateway supports all the payment methods that are popular in your industry, region, or country. If your business is international, your customers should be able to pay no matter what currency they hold. Popular payment gateways offer multicurrency support with or without surcharges. If you’re going to use a hosted payment processor, there are also localized checkouts available.

Ensure your product type is permitted by the provider

Usually, payment providers distinguish between two types of products: digital and physical. Several payment solution providers offer their services for both physical and digital products. But often, only one type of product is supported. So before you sign up with a vendor, make sure they support your products.

Choosing the right integration method

You can integrate a hosted payment gateway, integrate a gateway using the Direct Post method, or integrate a non-hosted gateway.

Hosted gateway

A hosted payment gateway requires your customers to leave your website to make a purchase.

Suitable for: Small or local businesses that are more comfortable using an external payment processor

The advantage of a hosted payment gateway is that the service provider takes over all payment processing functions. Customer card data is also stored by the gateway. Thus, using a hosted gateway does not require PCI compliance on the part of the merchant and offers fairly straightforward integration.

The downside is a lack of control over the hosted gateway. Customers may not trust third-party payment systems. Plus, redirecting customers from your site lowers your conversion rate and doesn’t help build your brand.

Direct Post method

Direct Post is an integration method that lets shoppers make purchases without leaving your website while still not requiring your site to be PCI compliant. Direct Post sends transaction data to the payment gateway after the customer clicks the Buy button. Data goes instantly to the gateway and processor rather than being stored on your own server.

Suitable for: Businesses of all sizes

The advantages of this method are the same as those of an integrated payment gateway. You get customization and branding options without the need for PCI DSS compliance, which we’ll talk about below. The user performs all payment actions on one page.

The downside is that Direct Post is not entirely secure.

Non-hosted (integrated) method

A non-hosted payment gateway allows you to keep users on your site during the purchase process. Non-hosted payment gateway providers allow for API integration.

Suitable for: Medium to large businesses that rely heavily on branding and usability

The advantages of an integrated payment gateway are that you have complete control over transactions on your website. You can set up your payment system at your discretion and adapt it to your business needs.

The disadvantages usually boil down to maintaining your payment system infrastructure and associated costs. To use an integrated gateway, you must be PCI compliant because you will have to store all of your customers’ credit card data on your servers. Also, gateway integration can be tricky if you want to add custom functionality.

5 best payment gateways

1. PayPal

With over 220 million active accounts worldwide, PayPal is undoubtedly the most widely used payment platform. Founded in 1998 as Cofinity, PayPal allows you to make and receive payments worldwide.

PayPal provides payment processing services to ecommerce providers, auction sites, and other commercial organizations around the world, and it accepts credit cards including Amex and Visa. It also offers easy cart integration, lots of customization options, and online billing. Plus, it makes it easy to pay by credit card over the phone.

PayPal is commonly associated with the eBay online marketplace, but it’s worth noting that it stopped being the main payment method for eBay in 2020 when the company switched to Adyen, though PayPal is still offered as an optional payment service. In a statement, eBay said it took this step to offer customers more competitive pricing.

PayPal recently completed its acquisition of Honey Science Corp., a digital shopping and rewards platform, for roughly $4 billion in cash.

The advantage of PayPal is that sellers don’t have to pay after the sale. When using PayPal Standard, customers can leave a seller’s website to place an order and log in to their PayPal account, or they can pay with a credit card or Visa card without registering. PayPal Pro allows merchants to customize the entire checkout process so buyers don’t have to leave their site. PayPal also accepts credit cards by fax, mail, and phone.

Pros and Cons of PayPal

- Ideal for low-volume sellers

- Predictable fixed price

- Unified payment system

- Not suitable for high-risk industries

- Inconsistent customer support

PayPal is often integrated as a hosted payment solution. PayPal Payments Pro allows you to integrate PayPal checkout directly into your website. PayPal Express Checkout is the easiest option, as it simply adds a PayPal button to your website. Braintree is a separate payment solution, but it’s a division of PayPal. The main benefit of Braintree is that it charges no additional fees for international transactions.

Pricing: PayPal’s pricing model includes various micropayment calculations, charges for the use of the platforms, and fees for international transactions. US-based transactions are billed at 2.9% + $0.30 per transaction.

Outside the US, the transaction fee is 3.9% and up depending on the currency used. There’s no monthly fee for the standard PayPal service, but Payments Pro costs $30 a month. The chargeback amount is $20 compared to Braintree’s $15, and there’s no installation fee.

2. Stripe

Stripe is another powerful payment platform designed for online businesses. The company claims to process billions of dollars in transactions every year. The main difference between Stripe and many other services is that it’s not a ready-made solution. Instead, Stripe provides a range of flexible tools that allow you to customize your own payment processes.

Stripe accepts all major payment methods and supports mobile payment providers such as Apple Pay, WeChat Pay, Alipay, and Android Pay.

Designed for large companies, Stripe offers a variety of APIs that allow you to build your own subscription services, on-demand marketplaces, or crowdfunding platforms. It supports a number of development languages including Ruby, Python, PHP, and Java.

In addition, Stripe supports over a hundred currencies and offers features such as mobile payments, subscription billing, and one-click payments. Users also have access to a dashboard where they can visualize transactions. While it’s a feature-rich payment gateway, Stripe requires a lot more technological knowledge to implement compared to other gateways.

Pricing: Stripe does not charge setup fees. The fee with the standard package is 2.9% + $0.30 per transaction. Additionally, a 1% commission is charged for processing international cards. But Stripe also offers a customized solution and pricing package for large businesses. The chargeback amount is $15. Stripe offers a special rate for merchants based in Europe, with 1.4% commission for European cards along with a small transaction fee.

Pros and Cons of Stripe:

- Documentation makes customizing your site simple and easy

- Ideal for international traders

- Great website and advertising

- Not suitable for high-risk industries

- Issues with account stability

3. Amazon Payments

Amazon is an ecommerce payment gateway that provides customers with a secure and simplified payment service. It works entirely with data already provided by customers in their Amazon accounts to complete registration and verification.

With single sign-on, Amazon customers can be instantly authenticated and can complete transactions via websites and mobile apps. Amazon Payments supports multiple languages and leading currencies to reach an international audience.

Pricing: Domestic transactions are billed at 2.9% + $0.30 per transaction. International transactions are charged a 3.9% fee. The refund amount is $20 + taxes, if applicable. There are no setup or monthly fees.

Pros and Cons of Amazon Payments:

- Amazon does not charge any additional fees for the A-to-Z Guarantee, making transactions 100% secure.

- You can easily customize Amazon Payments to match your site’s look and feel.

- Expensive for large sellers

- Not recommended for businesses that require a single processor for both personal and business transactions

4. Authorize.net

Founded in 1996, Authorize.net (owned by Visa) is one of the most popular payment gateway providers for ecommerce businesses. About 400,000 merchants use the Authorize.net payment gateway to accept credit cards and electronic checks, and 83% of Authorize.net customers are located in the United States.

The main goal of payment gateways is to simplify the payment process, and Authorize.net does just that. Designed for businesses of all sizes and offering a choice of pricing plans, the platform gives merchants tools to sell items and accept payments online or in-person.

You can use Authorize.net to accept payments from websites and quickly transfer funds to your bank account. It supports major credit cards including Visa, MasterCard, American Express, Discover, Diner’s Club, and JCB. In addition, it’s compatible with digital payment services such as Apple Pay, PayPal, and Visa Checkout.

Although Authorize.net software can accept transactions from customers around the world, your business must be registered in the US, UK, Canada, Europe, or Australia if you want to use this service.

Pricing: 2.9% + $0.30 per transaction. The monthly gateway fee is $25 and the monthly merchant account opening fee is $49. You can subscribe to the Authorize.net payment gateway if you already have a merchant account.

Pros and Cons of Authorize.net:

- Wide variety of currencies supported

- Robust security and fraud protection

- No long-term contracts

- High fixed price for an additional trading account

- All-in-one option can be confusing for customers

5. 2Checkout

2Checkout provides customizable options for businesses of all sizes as well as integrated payment solutions. Its biggest advantage is scalability, with packages for different types of products.

If you’re looking for instant payments, 2Checkout will be a great fit. It’s a full-featured payment processing solution that’s included in all lists of top payment gateways. This renowned US payment gateway provider enables your business to become profitable worldwide with support for 15 languages and 87 currencies.

Keeping your business in mind, 2Checkout customizes every detail of your checkout, providing a personalized experience for your customers.

Pricing: 2Checkout includes three packages with different commissions. There are no setup fees, monthly fees, or recurring fees. 2Sell’s commission is 3.5% + $0.35 per transaction. 2Monetize, a package aimed at digital product sellers, charges 6.0% commission + $0.60 per transaction.

Pros and Cons of 2Checkout:

- Documentation makes customizing your site simple and easy

- Ideal for international traders

- Great website and advertising

- Not suitable for card merchants

- Not suitable for high-risk sellers

Final advice on what to consider when choosing a payment gateway

Before you choose an ecommerce payment gateway based on the functional requirements of your ecommerce business, you need to consider the following:

1. Payment flow

As your business grows, your ecommerce payment gateway must be able to easily scale. When adding a payment gateway to your website, you need to select the payment flow that works best for your business.

2. Customers’ safety and security

Large companies have created online shopping opportunities that have increased customers’ expectations of all ecommerce websites. Even if you’re a small business, your customers will expect a quality website that works with the safest payment methods.

Some payment gateways allow you to customize the entire payment process to reflect your brand’s font, logo, and color palette. Because of this, some customers may be unaware that they’re temporarily being redirected to a third-party website for secure transaction processing.

Make sure your payment gateway provider meets information security standards such as PCI DSS, which is required by card brands but administered by the Payment Card Industry Security Standards Board.

3. Fees and service agreements

Pricing for payment gateways usually depends on the type of transactions a business conducts (online or in-person) as well as on sales, revenue stability, transaction frequency, and markets served.

It’s imperative to compare how your business model matches the fee structure of a payment service provider or gateway. Some services may charge setup fees and contract fees.

4. Integration process

Most payment gateways provide detailed instructions on how to integrate with popular ecommerce platforms like Shopify, Magento, and WooCommerce.

The ideal solution is to choose a payment gateway that won’t slow down the checkout process. Choose a payment gateway that allows your customers to easily make payments on your website and choose the payment method.

5. Features to choose from

Online payment gateway providers offer multiple features to meet different business needs. For example, if you need to deliver products and services around the world, your payment gateway can provide a global solution and take credit cards and debit cards in various currencies.

Payment gateways also affect your business performance. Be sure to check if your chosen payment gateway supports e-billing, all payment types, text and email reminders for customers, smart chargeback management, and other features.

If you’re interested in adding a payment gateway to your ecommerce project but don’t know where to start, contact Mobindustry for a free consultation.