How to Create a Buy Now Pay Later App Like Klarna or Afterpay

In this article, we dive into the world of buy now, pay later app development and provide you with examples of the best apps on the market.

Buy now, pay later: how it works

In its simplest form, buy now, pay later (BNPL) is like using a credit card or getting a soft loan. Pay later purchases allow customers to buy items online and pay for them in installments over a specified period, such as a few months.

This is a convenient way to pay when shopping online without having to pay the full price at the checkout. The process is greatly simplified so that customers can get a loan quickly and easily. The loan must be repaid on time to avoid late fees and affecting the customer’s credit score.

As today’s consumers are looking for flexible financing options, especially interest-free financing due to the financial hardship caused by COVID-19, BNPL has become a favorite payment method for many.

Best examples of buy now, pay later apps

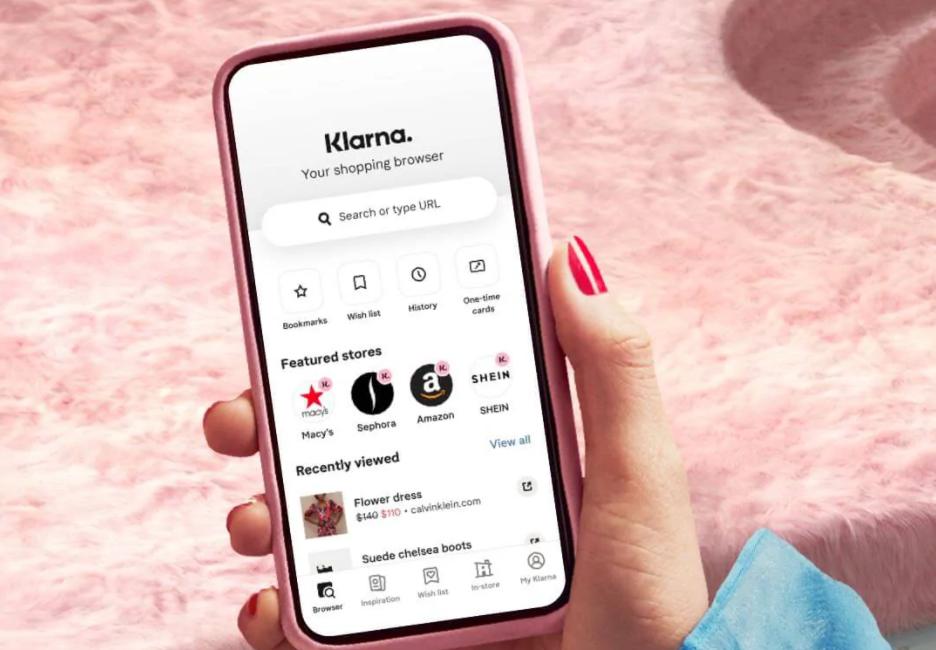

Klarna

Klarna is one of the most famous buy now, pay later platforms. It has over 80 million customers in 17 countries.

How does Klarna work?

Klarna’s goal is to make the shopping process more streamlined. Klarna lets users pay for purchases in four interest-free installments. It also alerts customers when their favorite retailers offer deals.

When paying with Klarna, customers are charged the first installment when the merchant confirms the order. The following three installments are automatically charged from customers’ accounts every two weeks. If users miss payments, Klarna charges a $3 late fee for orders under $100 and $7 for orders of more than $100.

Сonditions of shopping with Klarna

- Ghost card. Customers can use Klarna as a payment method at retailers that do not officially work with the service. To do this, they can use the platform’s virtual Visa card at checkout.

- Returns. If users want to return their purchases, Klarna will make a full refund.

- Slack period. If a user misses a payment, they’ll be given a “slack period” of two to seven business days.

- Low fees. The charges for using Klarna are relatively low.

How does Klarna make money?

As with most buy now, pay later services, Klarna makes most of its revenue by charging fees to merchants. The transaction fee is 30 cents per sale. Some portion of revenue also comes from late fees.

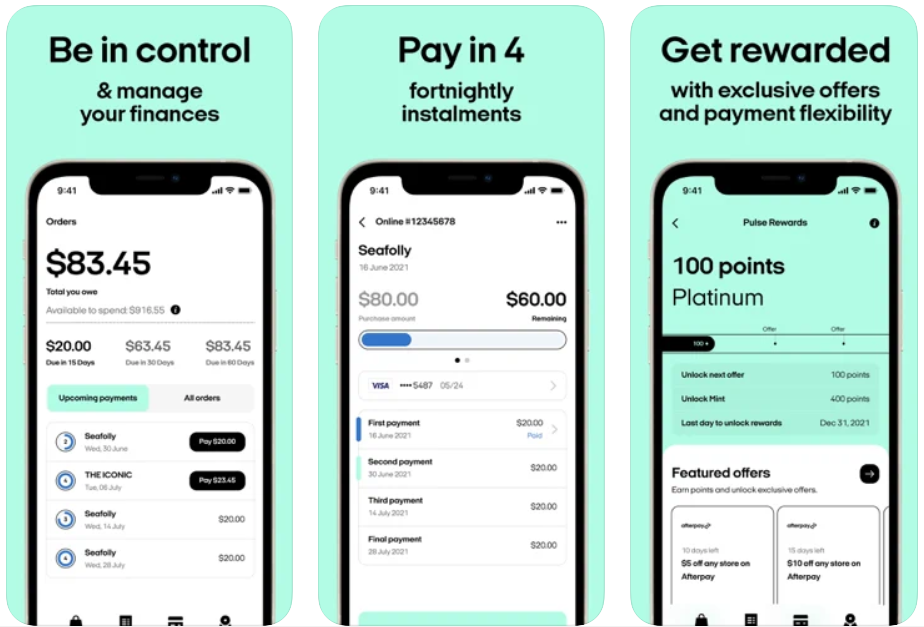

Afterpay

One of the most popular buy now, pay later providers is the Australian Afterpay. To use Afterpay, customers simply choose it as their payment method when making an online purchase. They then have eight weeks to pay the amount back in four installments, with no fees if all payments are made on time.

How does Afterpay work?

Customers can start using Afterpay by signing up and adding an Australian Visa or Mastercard debit or credit card. There are two ways to use Afterpay:

- Online. Buy things online and select Afterpay during checkout.

- In-store. While at the checkout in a physical store, a customer can use their phone to visit the Afterpay website and enter the cost of the purchase. They will then get a barcode to scan at the cash register.

Two weeks after making a purchase, Afterpay users need to pay back the first 25% of the credit amount. The remaining installments of 25% each need to be paid back every two weeks after that. Customers receive reminders before payments are due to help them avoid missing payments. Purchases over $500 require the first 25% payment to be made right away.

Conditions of shopping with Afterpay

- No interest. The service works as a no-interest loan.

- Easy in-store purchases. Customers who don’t have an account can still use Afterpay. They just need to sign up later in order to make payments.

- Account management. Customers can see their upcoming payments, orders, and account information.

- Reminders. To avoid overdrafts, Afterpay sends notifications that remind users about upcoming payment amounts and due dates.

- Automatic deductions. Afterpay automatically charges each payment from a user’s chosen card. This decreases the number of failed payments.

- Refunds. With Afterpay, customers can still get refunds according to the store’s refund policy.

- Pay in advance. Users can pay installments ahead of time.

- Security. Afterpay is a PCI DSS Level 1 certified service provider.

How does Afterpay make money?

Afterpay’s main revenue comes from charging retailers fees for offering the service. A small percentage of revenue comes from users’ late fees. If for some reason a charge to a user’s card is unsuccessful, Afterpay will notify the user and give them a chance to choose a different payment method. If the payment still isn’t successful, Afterpay charges a $10 late fee.

If within seven days the user doesn’t pay the installment, they’re charged a further $7.

Benefits of buy now, pay later

Now let’s find out the benefits of BNPL for retailers.

- Full payment upfront. With BNPL services, retailers receive the full purchase amount upfront. Payment providers take on the credit risk so retailers don’t have to worry about late payments.

- Higher conversion rates. Customers tend to buy items if they can afford to take them home right away. Industry data shows that merchants can increase their conversion rate by 20% to 30% with a BNPL service.

- Higher average transaction cost. When customers are offered a buy now, pay later option, they are more likely to buy more items and spend more money than they would otherwise.

- Large client base. Buy now, pay later can attract customers who might not otherwise visit your store. Today, millions of consumers use BNPL services, and many of them are specifically looking for stores that offer them.

- Repeat shopping. Customers tend to make repeat purchases from retailers offering BNPL. Afterpay BNPL buyers make purchases more than 20 times a year on average.

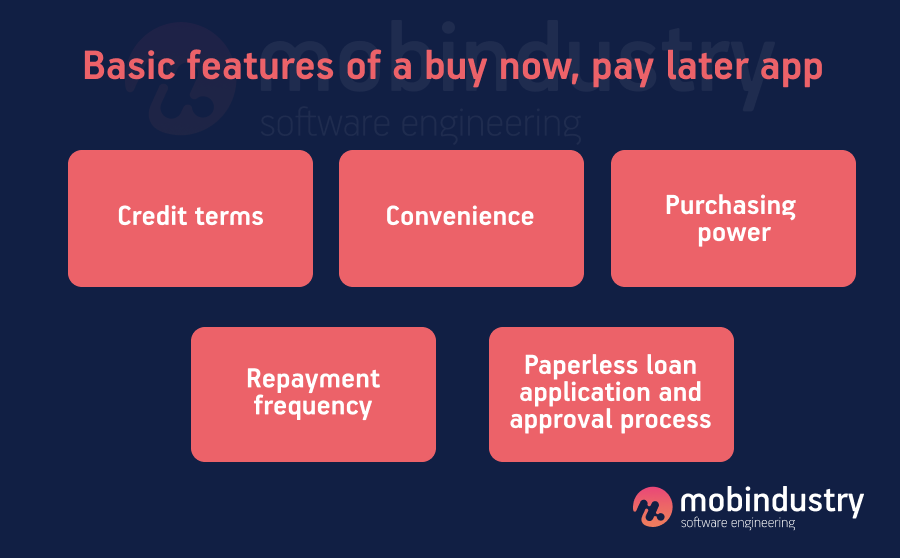

Basic features of a buy now, pay later app

The following are the main features of a buy now, pay later service:

- Credit terms. Some BNPL providers offer soft loan options that are repayable in a couple of weeks or a few months. Some high-value purchases may have a repayment period of more than two years.

- Convenience. Applying for a loan and obtaining approval takes a few minutes. This is done so quickly that the process can be initiated while the customer is at the point of sale or about to check out online.

- Purchasing power. Different BNPL providers have different limits on the loans they make to customers. Some may offer loans of up to $20,000.

- Repayment frequency. The loan offered to customers is repaid at a set interval. Clients may be required to pay in weekly or monthly installments. However, as a rule, merchants are paid in full upfront.

- Paperless loan application and approval process. Customers do not need to print or sign any documents.

8 steps to develop a buy now, pay later app

Here are eight steps to make your buy now, pay later app ideas come to life and simplify the development process.

1. Idea and concept

Developing a buy now, pay later app should begin with an original idea that is embodied in a concept. Answering the following questions will help you understand how to make a buy now, pay later app that stands out from the crowd:

- What unique features will make your buy now, pay later app different from competitors?

- What is the main idea behind the app?

- What value can you offer users?

2. Target audience

When developing a buy now, pay later app, the first thing you need to consider is the target audience. Understanding your users’ needs makes development easier and leads to a better final product. Find out as much as you can about your potential users. You can start by researching the following:

- Demographics. Find out the average age of your users, where they live, what devices they use, etc.

- Behavioral trends. Find out what decreases a user’s desire to download an app, your users’ security expectations, and so on.

To develop an amazing mobile application, we suggest creating a user persona, or a detailed portrait of your ideal user.

When you’re researching your product idea and deciding how to build your buy now, pay later app from scratch, you should also determine who your target audience is. It’s not enough to know the target audience’s age, place of residence, financial situation, and hobbies; you need to think about your app users in terms of numbers.

Once you start thinking about how to create a buy now, pay later app from scratch, you should start by doing some initial research on your target audience. This research can be done online, where you can search statistics, find communities, and explore other data.

The next step is to test your idea with real people.

You can interact with members of interest-based communities online or in real life.

The challenge here is to see how your idea resonates with your target audience and understand how to create a buy now, pay later app that communicates your idea.

3. Strategy

By now, you probably know a thing or two about how to create the buy now, pay later app of your choice, but there are a few more important points we should mention. It’s time to move on to the next step — building a business strategy for your app.

The wants and needs of the community you’re targeting should determine how you build a buy now, pay later app and what features you offer. What do your users expect? How do you want them to use your service? Knowing the answers to these questions makes it easy to determine which features to include in your buy now, pay later app.

You can start with an initial scaled-down version of your app and then expand it with new features and innovative technologies. If your resources permit, you can immediately launch a more feature-rich app or a fully fledged product. A less risky strategy is to start small, but how to build your buy now, pay later app is up to you.

4. Web development vendor

You cannot make your app successful without choosing the right web development company. If you are not a developer yourself and are not ready to take on this task alone, you will need someone who can provide professional website development services and who knows how to create a buy now, pay later app with all the necessary features. A good option is to choose IT outsourcing in Eastern Europe due to the excellent value for money.

Approach this task with caution, as you need to find a reliable partner who understands innovative technologies and, ideally, has previous experience with buy now, pay later apps.

5. Discovery phase

Once you’ve decided on a software provider, you can move to the first phase of app development — the discovery phase. During this phase, business analysis is carried out by a professional to determine the platform’s functional characteristics. The results of the business analysis are used to create the app’s UI/UX design, which will later be used to build the app from scratch.

6. Development

This stage is the most time-consuming, as it can take months to develop a buy now, pay later app, and it can take years of continuous development and iterations to build a complex and non-standard app.

However, a company with experienced professionals will be able to provide you with a plan for building a buy now, pay later app.

Software testing services are just as important as development itself. The first thing you should look out for is poor performance, as slow apps tend to scare away users. Testing should be done prior to deploying the project so you don’t have to troubleshoot issues after your app is launched. Keep this in mind when looking for information on how to create a buy now, pay later app from scratch.

7. Marketing and promotion

Marketing is an important part of building a buy now, pay later app, as without promotion, no one can find out about your product. You can promote your app in a variety of ways, one of which is by advertising on social networks like Instagram and Facebook. Other methods include email marketing, SEO techniques, blogging, and paid advertising.

As you can see, deciding how to create a buy now, pay later app from scratch is not enough, as you also need to keep in mind post-development activities such as promotion and advertising.

8. Ongoing maintenance and support

It’s not enough to know how to make a buy now, pay later app. You also need to know how to organize the ongoing maintenance of your project in order for it to function effectively in the future. Typically, a good web development provider can advise you on this and provide related services.

How much does it cost to build a buy now, pay later app?

The cost of developing a buy now, pay later app depends on these factors:

- Product features

- Product design

- Hourly rate of your development team

- Project size and complexity

- Technology stack

- Number of team members on the project

- Time frame

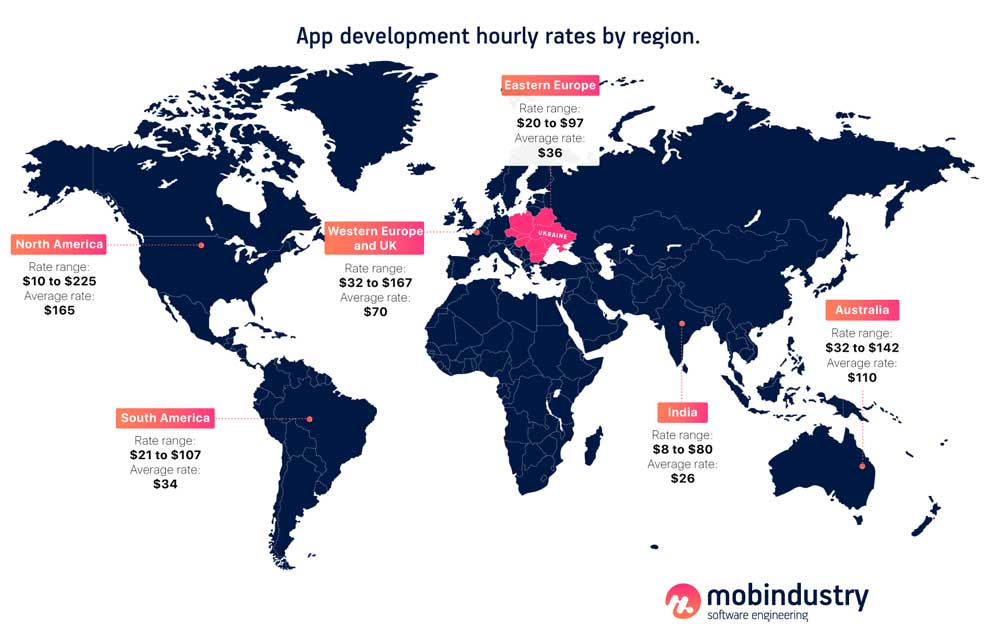

The biggest factor that influences a project’s cost is the hourly rate of developers, and that often depends on their location. For example, an application that costs $40,000 to build in the US will cost around $9,000 if developed by engineers in Ukraine.

Developing your project with a company based in Eastern Europe is cost-effective and gives you access to top talent.

Final thoughts

We hope this article has shed light on the world of buy now, pay later technology. Here are the key takeaways:

- When developing a buy now, pay later app, the first thing you need to consider is your target audience. Understanding your users’ needs makes development easier and leads to a better final product.

- Research the fees of different providers to choose the most suitable solution. It’s best to choose a trusted payment provider with a strong user base. A well-known BNPL provider will showcase you to more people and attract customers to your store.

- Attract your customers’ attention with an official announcement of your new payment option.

- Developing your project with a company based in Eastern Europe is cost-effective and gives you access to top talent.

If you want to implement a buy now, pay later option for your business or if you have any questions regarding this topic, contact Mobindustry for a free consultation.