Buy Now, Pay Later (BNPL) Market Overview: Trends and Technologies

Interested in adding a buy now, pay later (BNPL) system to your ecommerce business? In this article, we talk about the buy now, pay later model main features are, how to implement it, and what benefits it can bring to your business.

Buy now, pay later market overview

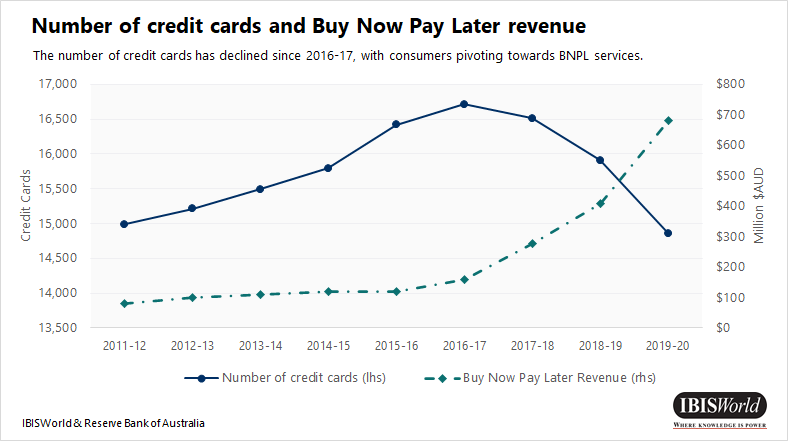

A recent report from IBISWorld predicts the Buy Now Pay Later (BNPL) industry will continue to grow 9.8% annually over the next five years to $ 1.1 billion.

During the Covid-19 “BNPL service providers are likely to benefit from consumers using industry services for essential items,” IBISWorld senior industry analyst, Yin Yeoh said. IBISWorld notes that some Australians have used BNPL to buy essential items like clothing and groceries.

Afterpay’s current market capitalization is $ 17.7 billion after the share price jumped from $ 8.90 on March 23 to over $ 70 per share in July, pushing Afterpay out of the top twenty ASXs. Yin Yeoh stated that as bank accounts run out, more consumers are likely to turn to the Buy Now Pay Later market. The ability to shop now and pay becomes more and more attractive to consumers in financial distress.

IBISWorld predicts the BNPL market will grow 9.1% in 2020-2021, bringing it to $ 741.5 million, as online shopping revenue grows 6.4% this year to $ 31.2 billion. BNPL platforms such as Afterpay, Klarna, and Zip Pay are expected to receive some of this growth, IBISWorld reports.

Australians are increasingly moving away from credit cards: data from the Reserve Bank of Australia show that the number of used credit cards has decreased by 6.6% in the last financial year. In May Australians ditched more than 100,000 credit cards, bringing the number of valid cards back to levels not seen since 2009. Given that interest-free services like AfterPay, and ZipPay are more popular among the younger generation, and free debit cards that regularly offer perks like $0 international transaction fees, the future of credit cards looks grim. Based on the state of the buy now, pay later market, we can say that the fintech app development will be quite popular in the upcoming years.

Benefits of buy now, pay later

Now let’s find out what the benefits are for retailers of BNPL services.

Up-front and in-full payments

With BNPL services, retailers get paid upfront and in full. Payment providers shoulder the credit risks, so you don’t have to worry about chasing after late payments.

Higher conversion rates

Shoppers tend to buy products if they can afford to take them home right away. Industry data shows that merchants can increase their conversion rates by 20% to 30% with a BNPL service.

Higher average transaction value

When customers are provided with a buy now, pay later option, they’re more likely to buy more products and spend more money than usual.

Larger customer base

A buy now, pay later service can attract customers who wouldn’t have visited your store otherwise. Today, there are millions of consumers who use BNPL services, and many of them are looking specifically for stores that offer them.

Repeat purchases

Customers tend to make repeat purchases more often with BNPL. Afterpay BNPL shoppers make purchases more than 20 times per year on average.

BNPL Trends and risks of 2022 – 2023

The buy now, pay later model is a trend in itself, but as it grows in popularity, it starts to transform. Let’s talk about what trends will be established in 2022-2023, and what risks come with the BNPL expansion.

Expansion across industries

The popularity of BNPL started with retail and fintech apps. Now, people can pay in installments for all kinds of services and products in a plethora of industries that include healthcare, insurance, B2B trading, travel, and even blockchain and cryptocurrency.

Today, businesses of all kinds partner with fintech services to offer BNPL services. For example, American Airlines partnered with Affirm to offer clients to “fly now, pay later”.

So, you can apply BNPL to any industry out there, because the only two characteristics of this model are the ability to pay later and do so in installments.

Banks will offer BNPL as well

BNPL leaders are competitors for banks, as people prefer them to take loans from banks. That’s why many banks are looking into offering BNPL themselves. Banks are experts in complying with regulations, and they also can use their extensive customer profiles to personalize BNPL offers based on how reliable a particular customer is.

Banks like Monzo, Revolut, and Santander offer BNPL services, others are getting ready to launch their buy now, pay later services as well.

BNPL will be an important part of super apps

Super apps will adopt BNPL as one of the steps in their customer journey, allowing users to pay in installments for any service and product from any online retailer, even if they don’t partner with a company that owns the super app. Klarna is one example, as it offers its BNPL service no matter where its customers shop.

So, the upcoming trend that we can already see is that super apps will emerge and offer an end-to-end shopping experience to their customers, which will include choosing, comparing, and paying for the products in installments. This will be achieved through partnerships with other businesses.

BNPL providers will do better risk assessments

Currently, BNPL providers don’t go deep when it comes to assessing risks. They stop at some soft credit checks and historical data on previous payments. This will change with new regulations. For example, in the UK, the regulators want BNPL businesses to match their service accessibility to the credit score of their customers.

BNPL providers will use an open banking strategy by partnering with third-party providers or making acquisitions to accurately assess the customer data and make personalized decisions on each customer. For this, they’ll need to use AI-based software for predictive analytics, and data-based decision-making.

Now let’s talk about the risks that BNPL companies may face in 2022-2023.

The main risk is of course the recession. As consumers are cutting spending, the growth of the BNPL market stalls. The shares of the top BNPL companies are down, and investors express less interest in such companies because of the financial risks.

Currently, like many other big companies, BNPL leaders are laying off staff, and smaller startups are struggling to get funding.

Apart from the financial risks, there are also regulatory risks. In the UK and Australia, the government is discussing how they’ll need to push regulations onto BNPL leaders and align them with credit laws.

The recession can be detrimental, but it can also be a time of opportunity. Let’s talk more about the challenges of BNPL so you can be ready.

Buy Now, Pay Later challenges

Many BNPL offers are suitable for customers with the highest credit scores. Since only Prime Lending is offered, many buyers are effectively “locked out” of the BNPL trend. For sellers, this means that a large proportion of potential customers have a bad payment experience and end up giving up on the sale. By only offering one BNPL supplier or by offering only Prime BNPL suppliers, merchants cannot win business from less qualified consumers.

The BNPL loan rejection rate is surprisingly high. In some cases, up to 70 percent, depending on the demographics and vertical. Merchants should offer the preferred payment methods that their customers want and expect to find when they checkout. But if the BNPL bounce rate is that high, many buyers don’t have the best payment experience. As already noted, the main reason for this slow adoption is that today most BNPL providers only use first-class lending.

BNPL can be expensive for merchants, 3-7% on top of the usual credit card processing fees. There is no doubt that BNPL is now a must for merchants who want to offer their customers the best payment option available, but it is not a cheap solution. It is true that sellers are paid up front and the BNPL provider takes care of collecting the money afterward, but the seller’s costs are an important consideration, especially if the margin is tight.

BNPL payments regulations

The buy now, pay later business model has become extremely popular and grew rapidly due to lack of regulation. However, this is bound to change soon, as more and more countries are planning to regulate the market leaders and make them play by the rules of traditional credit card products.

The UK is one of the first countries to restrict BNPL services by regulations and protect consumers who are often uninformed about the risks of taking loans from BNPL companies. Younger consumers with low credit scores start to take loans to pay off their BNPL purchases. We’ll see more rules on informing consumers and approaching credit scoring more seriously in the future.

The EU, UK, US, and Australia are currently discussing the regulations, so all BNPL businesses need to pay close attention to the upcoming changes and adapt to them.

BNPL business models

Embedded shops

I’ve already mentioned this model when we talked about the super apps that not only provide users with a shopping experience but also credit services. This business model improves customer experience and allows merchants to increase their revenue because they’re making their products more accessible via payments in installments.

Here, BNPL businesses make money by charging merchants a percentage of the consumers’ purchase price, and also a flat rate per transaction.

Card-linked financing

According to this model, the card issuers themselves provide BNPL services, allowing their customers to pay in installments. Here, a card isn’t linked to a specific merchant, so users can pay for products from any merchant. The merchant recognizes the BNPL virtual card as a regular credit card and receives the full payment amount. At the same time, the user pays this sum in installments, like with regular BNPL.

Off-card financing

According to this model, a user gets a credit with a 0% annual fee for the first few months, and then a subsidized fee. This type of BNPL is used for longer payment periods that take 9-10 months. Such loans can be applied to furniture, fitness equipment, home renovation, and other high and mid-ticket purchases.

Here, a BNPL service will pay more attention to checking the customer’s credit history and score.

Rent-to-own model

Here, a purchase will be a property of a service provider until a customer pays it off completely, although the customer will get the item or service the day the transaction took place. This service doesn’t offer a 0% APR, but charges from 1% to 5% annually. This model is specifically designed for people with low credit scores.

How to implement BNPL in your store

Here are a few tips on how to implement a buy now, pay later service in your store. But first, you need to find a BNPL service provider.

Here are some key factors you should consider when choosing a BNPL partner:

- Point of sale integration. To ensure a smooth checkout process, use a provider that integrates with your existing POS system. This way you’ll be able to reduce the need for manual work and double entry.

- Fees. It’s typical for buy now, pay later companies to charge a fee for processing payments. Usually, it’s in the form of a percentage of the purchase price plus a transaction fee. Research the fees of different providers to choose the most suitable solution.

- User base. It’s better to choose a trusted payment provider that has a strong user base. A well-known provider will showcase you to more people and attract customers to your store.

Basic components of buy now, pay later platforms

Buy now, pay later services usually have the same core components:

- Loan terms. These depend on the provider and the retailer. For inexpensive purchases, loan terms can be a few weeks to six months. For big purchases, customers can pay for two or more years.

- Purchasing power. The purchasing power usually depends on the provider. BNPL providers offer loans of up to $30,000.

- Repayment frequency. Consumers pay back credit in weekly or monthly installments, while merchants are usually paid back in upfront and in full.

- Convenience. Everything is done quickly and easily. Customers can apply for loans and get approved in minutes at the point of sale or online.

- Paperless. Everything from the application process to loan management is done online. With buy now, pay later, customers don’t have to physically print or sign anything.

How to encourage customers to use buy now, pay later

So what should you do after implementing buy now, pay later functionality? You should start spreading the word to encourage your customers to use this payment option.

Here are a few tips on how to attract customers to your buy now, pay later service.

Announce it

Attract your customers’ attention with an official announcement of your new payment technology. For example, if you have a customer email list, you can send all your customers a message telling them about buy now, pay later and encouraging them to use it in-store.

Another good idea would be to include product mentions to give customers an idea of what they could purchase using BNPL.

Display signs

Let customers know about your buy now, pay later services by placing informational banners on your site and icons on product pictures.

Get listed in your BNPL provider’s directory

Most buy now, pay later providers to have directories listing the retailers that offer their services. This puts your business in front of potential new customers who are looking to take advantage of your BNPL offerings.

BNPL app technology stack to consider

We’ve talked about business models, rules, regulations, and other aspects of BNPL business, let’s now talk about the technical aspect of it.

If you have an existing store, you can add BNPL functionality by partnering with a provider. But what if you’d like to create a standalone BNPL application and become a provider yourself?

The key element of any BNPL solution is data about consumers, their credit scores, credit history, purchase behavior, and more. The architecture of a buy now, pay later app consists of microservices and APIs that can be connected to outside merchants through authentication and authorization.

To handle data in each module, you’ll need an SQL database, and the data management should happen according to the Rational database management system.

The main goal of your app will be to offer merchants a way to generate more revenue by giving consumers the ability to pay in installments. You need to assess these consumers, so for this, you’ll need to integrate ML modules for decision-making.

For an app itself, you can use any mobile technology, native or cross-platform. If you’d like your app to work on both platforms, I suggest using Flutter.

Top 3 buy now, pay later providers

Afterpay

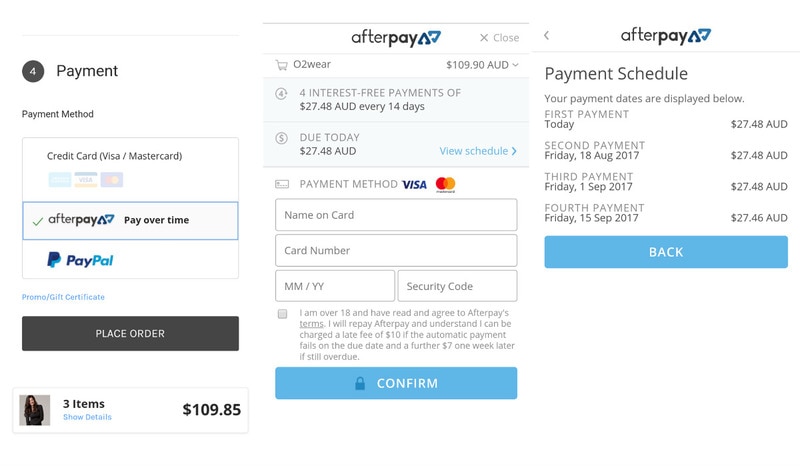

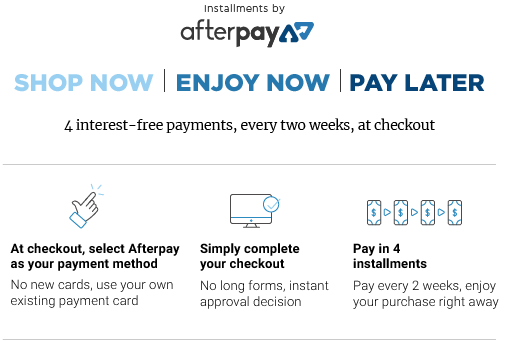

One of the most popular buy now, pay later providers is the Australian Afterpay. To use Afterpay, customers simply choose it as their payment method when making an online purchase. They then have eight weeks to pay the amount back in four installments, with no fees if all payments are made on time.

How does Afterpay work?

Customers can start using Afterpay by signing up and adding an Australian Visa or Mastercard debit or credit card. There are two ways to use Afterpay:

- Online. Buy things online and select Afterpay during checkout.

- In-store. While at the checkout in a physical store, use your phone to visit the Afterpay website and enter the cost of your purchase. Then you’ll get a barcode that you simply scan at the cash register.

Two weeks after making a purchase, Afterpay users need to pay back the first 25% of the credit amount. The remaining installments of 25% each need to be paid back every two weeks after that. Customers receive reminders before payments are due to help them avoid missing payments. Purchases over $500 require the first 25% payment to be made right away.

Conditions of shopping with Afterpay

- No interest. The service works as a no-interest loan.

- Easy in-store purchases. Customers who don’t have an account can still use Afterpay. They just need to sign up later in order to make payments.

- Account management. People can see their upcoming payments, orders, and account information.

- Reminders. To avoid overdrafts, Afterpay sends notifications that remind users about upcoming payment amounts and due dates.

- Automatic deductions. Afterpay automatically charges each payment from a user’s chosen card. This decreases the number of failed payments.

- Refunds. With Afterpay, customers can still get refunds according to the store’s refund policy.

- Pay in advance. Users can pay installments ahead of time.

- Security. Afterpay is a PCI DSS Level 1 certified service provider.

How does Afterpay make money?

Afterpay’s main revenue comes from charging retailers fees for offering the service. A small percentage of revenue comes from users’ late fees. If for some reason a charge to a user’s card is unsuccessful, Afterpay will notify the user and give them a chance to choose a different payment method. If the payment still isn’t successful, Afterpay will incur a $10 late fee.

If within seven days the user doesn’t pay the installment, they’re charged a further $7.

Zip Pay

Zip Pay by Zip Co. is similar to the Afterpay interest-free payment service.

How does Zip Pay work?

Once users have signed up for Zip Pay, they can make purchases online (by choosing Zip Pay as their payment method during checkout) or in-store. Users can sign in to their Zip Pay accounts and select Zip Pay as the payment method during checkout.

After making purchases, users can choose their repayment frequency:

- weekly

- every two weeks

- monthly

The minimum loan amount that Zip Pay offers is $350, and the maximum amount is $1,000. The service requires a minimum monthly payment of $40. If payment isn’t made by the end of the month, Zip Pay charges a $6 monthly fee.

Conditions of shopping with Zip Pay

- Interest-free repayment. Zip Pay doesn’t charge any fees unless a user missed a payment.

- Low fees. The late fee is $6, which is a bit lower than Afterpay and lower than nearly any credit card.

- Credit limits. Zip Pay has three different credit limit options: $350, $500, and $1,000. The company’s algorithm approves each user for one of these limits.

- Simple sign-up process. Zip Pay lets users sign up via Facebook or PayPal.

- Automatic deductions. Users can set up direct debit from their bank accounts.

How does Zip Pay make money?

Zip Pay is free to integrate but charges a merchant fee depending on the kind of business and the interest-free period you choose to offer to your customers. The transaction fee is a maximum of 30 cents per sale, and the more customers pay with Zip Pay, the cheaper the per-customer transaction fee is for the merchant. Zip Pay also makes some money off the $6 late fee charged to customers.

Klarna

Klarna is one of the most famous buy now, pay later platforms. Today, it has over 80 million customers in 17 countries.

How does Klarna work?

Klarna’s goal is to make the shopping process more streamlined.

Klarna lets users pay for purchases in four interest-free installments. It also alerts customers when their favorite retailers offer deals.

When paying with Klarna, customers are charged the first installment when the merchant confirms the order. The following three installments are automatically charged from customers’ accounts every two weeks. If users miss payments, Klarna charges a $3 late fee for orders under $100 and $7 for orders of more than $100.

Сonditions of shopping with Klarna

- Ghost card. Customers can use Klarna as a payment method at retailers that are not signed up for the service. To do this, they need to use the platform’s virtual Visa card at checkout.

- Returns. If users want to return their purchases, Klarna will make a full refund.

- Slack period. If a user misses a payment, they’ll be given a “slack period” of two to seven business days.

- Low fees. The charges for using Klarna are relatively small.

How does Klarna make money?

As with most buy now, pay later services, Klarna makes most of its revenue by charging fees to merchants. The transaction fee is 30 cents per sale. Some portion of revenue also comes from late fees.

Quick summary of buy now, pay later

We hope this article has shed light on the world of buy now, pay later technology. Here are the key takeaways:

- To ensure a smooth checkout process, use a BNPL provider that integrates with your existing POS system.

- Research the fees of different providers to choose the most suitable solution. It’s best to choose a trusted payment provider with a strong user base. A well-known BNPL provider will showcase you to more people and attract customers to your store.

- Attract your customers’ attention with an official announcement of your new payment option.

If you want to implement a buy now, pay later option for your business or if you have any questions regarding this topic, contact Mobindustry for a free consultation.

Frequently Asked Questions

- Point of sale integration

- Fees

- User base

- Afterpay

- Zip Pay

- Klarna

- Announce it

- Display signs

- Get listed in your BNPL provider’s directory